GREAT, LLC IS AN EXPERIENCED, FULL-SERVICE REAL ESTATE ADVISORY COMPANY PROVIDING INDEPENDENT RESEARCH AND CONSULTING SERVICES FOR REAL ESTATE INVESTORS, DEVELOPERS, AND INSTITUTIONS. WE FOCUS ON DEVELOPING STRATEGIES AIMED AT IMPROVING OPERATIONS, UNLOCKING VALUE, AND MINIMIZING RISK.

WE SPECIALIZE IN THE ANALYSIS, MANAGEMENT, AND DEVELOPMENT OF A BROAD RANGE OF RESIDENTIAL AND COMMERCIAL REAL ESTATE. WE FOLLOW A DISCIPLINED AND PRAGMATIC APPROACH TO PROGRAMMING, DESIGN, AND MANAGEMENT, TAILORED TO MEET THE UNIQUE ASPECTS OF EACH INDIVIDUAL PROJECT.

WE ARE CREATIVE, THOUGHTFUL, RESPECTFUL, TECHNICAL, ECONOMICAL, AND SOLUTION DRIVEN.

GReAT Services

GReAT offers a multi-disciplined approach to assist lenders, investors, receivers, attorneys, and real estate professionals understand the physical, economic, financial, and legal status of each property within the portfolio to unlock the maximum value of each asset.

We staff our team with a select set of real estate professionals with advanced degrees in architecture, engineering, planning, law, construction and business depending on the assignment. We have experience managing the process of planning, designing, permitting, budgeting and scheduling, negotiating with contractors, and constructing development projects of all sizes.

We provide services from pre-acquisition through property sale and across an array of industry sectors including commercial mixed use, master planned communities, office, industrial, and retail properties. We take the time necessary to evaluate the needs and objectives of each project and tailor our services accordingly.

The services we offer are broadly categorized into Due Diligence + Development & Investment Strategy, Development Management + Owner Representation, and Valuation + Cash Flow.

GReAT Projects

Mixed Use

Master Planned Communities

Longbow Business Park & Golf Club

Park Place

Summit Business Park

83West10 Commerce Park

Middle Mountain

Gilbert Town Center

Dover Industrial Park

Adobes de la Tierra

Stonehaven (Mirabel)

Cahava Springs

Copper Basin

Brighton Village

Office + Industrial + Retail

Owner Representation

The HUB

Centennial

Small Bay at Summit Business Park

Park Place Executive Offices

Diablo Technology Prk

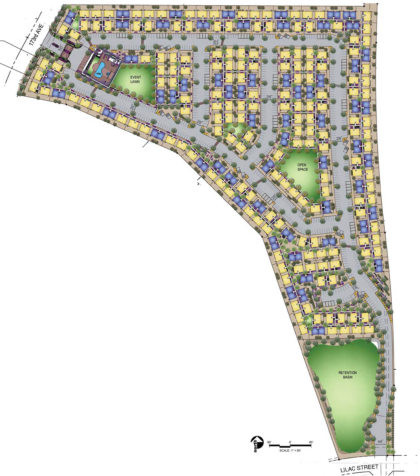

Terralane Communities Park McDowell

Terralane Communities South Mountain

Terralane Communities on Cotton

Terralane Communities at Canyon Trails North

Terralane Communities at Canyon Trails South

Valuation + Cash Flow

Due Diligence

First Industrial Real Estate Trust

Singerman Real Estate

Dover Associates

Daedalus Real Estate Advisors

Cyburt Hall Partners

Capital Hall Partners

Apache Land Company

Buckeye Business Park

Middle Mountain

Union Park Phase 3

Vistancia Master Plan

Gilbert Town Center

83rd & Van Buren

GReAT Research

In addition to our services and projects, we have prepared numerous documents to provide information and guides for developing and investing in real estate.

The following articles, are posted as an additional resources providing practical applications of fundamental concepts for real estate development & investment.

All rights reserved. All documents are password protected. For information on gaining access, please email admin@greatcompaniesllc.com

Introduction to Real Estate

Cash Flow Analysis

Learning Excel

Preparing a Land Development Pro Forma + Land Development Anywhere USA Case Study

Preparing a Single Building Triple Net Lease Pro Forma – Any NNN Building USA Case Study