GReAT, LLc is a full-service real estate advisory firm trusted by investors, developers, and institutions for our independent research and hands-on consulting expertise. We develop smart, data-driven strategies that help clients improve operations, unlock value, and manage risk effectively.

With experience across a wide range of residential and commercial assets, we offer tailored solutions in analysis, asset management, and development. Our work is grounded in a disciplined, pragmatic approach to programming, design, and execution, adapted to the unique demands of each project.

Above all, we are creative, technical, economical, respectful, and solution-driven and dedicated to producing measurable, meaningful results.

GReAT Services

GReAT offers a multidisciplinary approach to help lenders, investors, receivers, attorneys, and real estate professionals evaluate the physical, economic, financial, and legal status of each property within a portfolio—unlocking the full value of each asset.

Our team is composed of carefully selected real estate professionals with advanced degrees in architecture, engineering, planning, law, construction, and business. We bring extensive experience in managing all phases of the development process, including planning, design, permitting, budgeting, scheduling, contractor negotiations, and construction for projects of all sizes.

We provide comprehensive services from pre-acquisition through disposition, working across a range of industry sectors including commercial mixed-use, master-planned communities, office, industrial, and retail properties. We take the time to understand each project’s unique goals and tailor our approach accordingly.

Our services are broadly organized into the following categories:

Due Diligence + Development & Investment Strategy

Development Management + Owner Representation

Valuation + Cash Flow Analysis

GReAT Projects

Since 2000, GReAT has completed a wide range of real estate development and investment projects across the United States, with a particular focus on Arizona. Our portfolio includes commercial mixed-use developments, master-planned communities, residential build-to-rent developments, office buildings, industrial facilities, and retail centers.

Navigate to the Projects tab for more information.

Mixed Use

Master Planned Communities

Longbow Business Park & Golf Club

Park Place

Summit Business Park

83West10 Commerce Park

Middle Mountain

Gilbert Town Center

Dover Industrial Park

Adobes de la Tierra

Stonehaven (Mirabel)

Cahava Springs

Copper Basin

Brighton Village

Office + Industrial + Retail

Owner Representation

The HUB

Centennial

Small Bay at Summit Business Park

Park Place Executive Offices

Diablo Technology Park

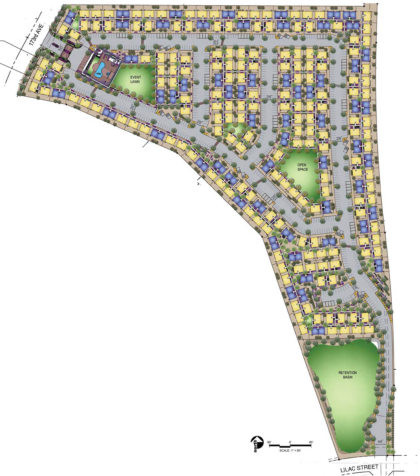

Terralane Communities Park McDowell

Terralane Communities South Mountain

Terralane Communities on Cotton

Terralane Communities at Canyon Trails North

Terralane Communities at Canyon Trails South

Villas on Camelback

Villas on Sarival

Valuation + Cash Flow

Due Diligence

First Industrial Real Estate Trust

Singerman Real Estate

Dover Associates

Daedalus Real Estate Advisors

Cyburt Hall Partners

Capital Hall Partners

Apache Land Company

Buckeye Business Park

Middle Mountain

Union Park Phase 3

Vistancia Master Plan

Gilbert Town Center

83rd & Van Buren

GReAT Research

In addition to our advisory services and development work, we offer a curated collection of articles and reference materials to support real estate professionals, students, and investors.

Originally created for students in the Master of Real Estate Development program at the W. P. Carey School of Business (Arizona State University), these resources have since become widely used by a broader audience of commercial real estate learners and practitioners.

Our content is organized into three key areas:

Introduction to Real Estate

Learning Excel

Cash Flow Analysis

Each section is designed to strengthen your foundation in real estate financial modeling and sharpen the analytical skills essential to succeeding in the industry.

All materials are authored and published by Michael Bronska, Genesis Real Estate Advisory Team, LLC, and affiliated entities. © All rights reserved. No part of these resources may be reproduced, stored, or transmitted—electronically or otherwise—without prior written consent, except for personal viewing via this website.

Content may not be uploaded, distributed, or posted to any shared server or network.

For permission requests or more information, contact us at: admin@greatcompaniesllc.com

Introduction to Real Estate

Cash Flow Analysis

Learning Excel

Glossary of Real Estate Terminology and Useful Formula

Introduction to Real Estate Investment Analysis

Due Diligence and Underwriting for Real Estate Development & Investments

Calculating Development Capacity & Determining Development Yields

Introduction to Calculating Residual Land Value

Introduction to Lease Valuation

Calculating the Cap Rate using the Band of Investments Method

Preparing a Land Development Pro Forma + Land Development Anywhere USA Case Study

Preparing a Single Building Triple Net Lease Pro Forma – Any NNN Building USA Case Study